RESEARCH REPORT

Automotive customer experience rebooted

Pivoting toward the automotive industry’s future success

5-MINUTE READ

December 6, 2021

RESEARCH REPORT

Pivoting toward the automotive industry’s future success

5-MINUTE READ

December 6, 2021

When it comes to purchasing and using vehicles, today’s buyers are setting higher standards for OEMs and dealers. The demand is shifting from vehicle performance, design and price toward more connected, virtual and responsible experiences. What does this mean for OEMs? How can they compete in a marketplace where consumers are accustomed to an interactive, personalized experience?

To better understand the customer experience (CX) challenges and potential benefits in the automobile market, Accenture conducted extensive research, including surveys with 7,500 car-owners and 203 dealers across six countries, interviews with more than 20 experts, executives and industry insiders and analysis of more than 1.5 billion social media posts and 300 investment transcripts of leading automotive companies. We found that forming relationships and developing intra-industry ecosystems would help secure manufacturers’ future.

car-owner surveys conducted

Our findings point to two critical steps automotive manufacturers can take to improve sales and increase customer loyalty: utilizing consumer data and strengthening their relationships with dealers.

Today's consumers are setting higher standards for OEMs and dealers for a greater customer experience, increasing the complexity of the sales process, and requiring coordination among multiple parties. Three factors to watch in the next three years:

While vehicle performance, design and price will remain important, five other factors will become critical for a positive customer experience.

A majority of customers (62% – 65%) expect online, virtual and real-time response experiences from their automotive OEMs and dealers.

Our research points to a gap between OEM and consumer priorities, increasing challenges to build customer loyalty and generating more sales. While automotive executives are focused on future-related issues such as new energy vehicles, consumers are more concerned with practical, everyday considerations such as repairs and maintenance. What’s more, loyalty is at the bottom of priorities for both OEM executives and customers.

This disconnect and disengagement, among other issues, puts the entire sales model at risk for the automotive industry. More important, it leaves the traditional approach that OEMs and dealers have taken with customers—and each other—over the last century at considerable risk. To face this challenge, most OEMs realize they need to take a more data-driven approach to sales and aftersales.

of customers perceived that their OEM is not prepared to provide a relevant experience

of customers would switch to a different OEM if it delivered better customer experiences

of customers think about changing their automotive brand after a company fails to deliver a relevant customer experience

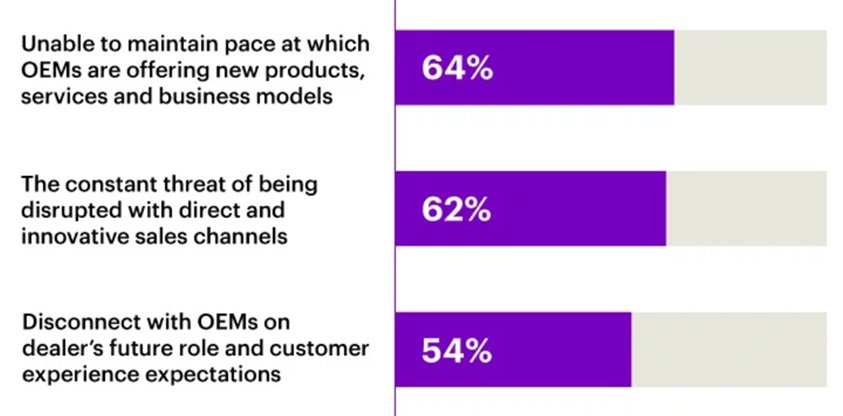

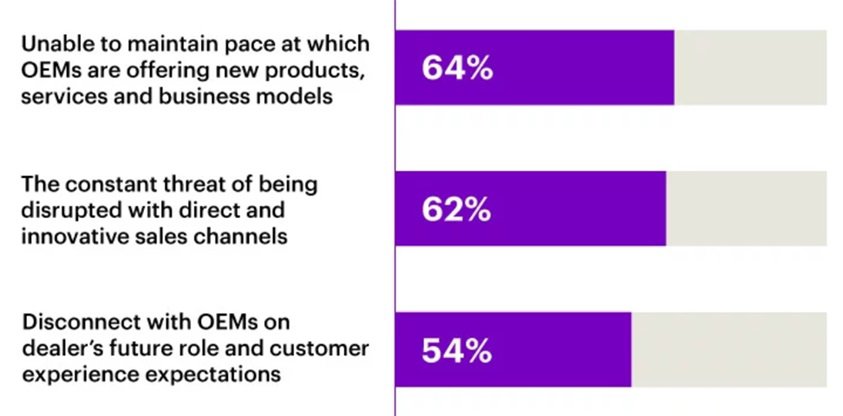

Aside from OEMs, dealers face challenges of their own, including a lack of organizational processes or an inconsistent, outdated IT infrastructure. However, many challenges are external—born from their fragmented relationships with OEMs. For example, dealers are not able to keep up with the pace of OEMs’ digitization efforts.

Perhaps most frustrating for dealers is that, although they contribute up to two-thirds of the entire customer lifecycle experience, OEMs are still not giving them the autonomy to act accordingly. It’s the dealerships that are building a seamless and appealing customer experience in the purchasing and post-purchasing periods (as they own the physical and digital contact with customers)—a complex process requiring close and seamless coordination with their OEMs.

In essence, there isn’t a uniform understanding of what ‘customer experience’ means. For the OEM, it is about tracking the entire customer journey; but for the dealers, it is only about aftersales.

Customer Relations Executive / A Major Global OEM

Data-driven services and the corresponding customer experience are going to be the next battlefields for the automotive industry. To win and keep customers, OEMs should not only closely analyze the data, but also consider changing the entire dynamic with their dealers.

Consumers’ desire for vehicles that respond dynamically to changing lifestyles and growing sustainability concerns is already changing the automotive industry’s business model—but there’s much more to come. A significantly more personalized human machine interface (HMI) is emerging, responsive to the needs and desires of individual users. This is the promise of My(H)MI - a personalized universe of digital interactivity between humans, vehicles, and the environment.

Quality data is only the starting point to derive real customer insights. A structured analysis and interpretation methodology should follow any data collection initiative. Also critical is a strong, overarching, company-wide data management system and utilization strategy.

Serving customers today, and into the future, is no longer only about meeting their mobility needs. Beyond engine power and vehicle features, OEMs must discern what customers really want. Today, OEMs (together with their dealers) have an opportunity to transcend their role as a mobility provider to become a long-term partner to their customers. This involves rethinking their entire ecosystem, particularly their relationship with dealers, engaging customers across all touchpoints with an intelligent data-driven approach and building agility across every facet of their operations.

of dealers surveyed see CX as extremely important to their future growth