RESEARCH REPORT

Towards the capital markets of tomorrow

5-MINUTE READ

June 2, 2021

RESEARCH REPORT

5-MINUTE READ

June 2, 2021

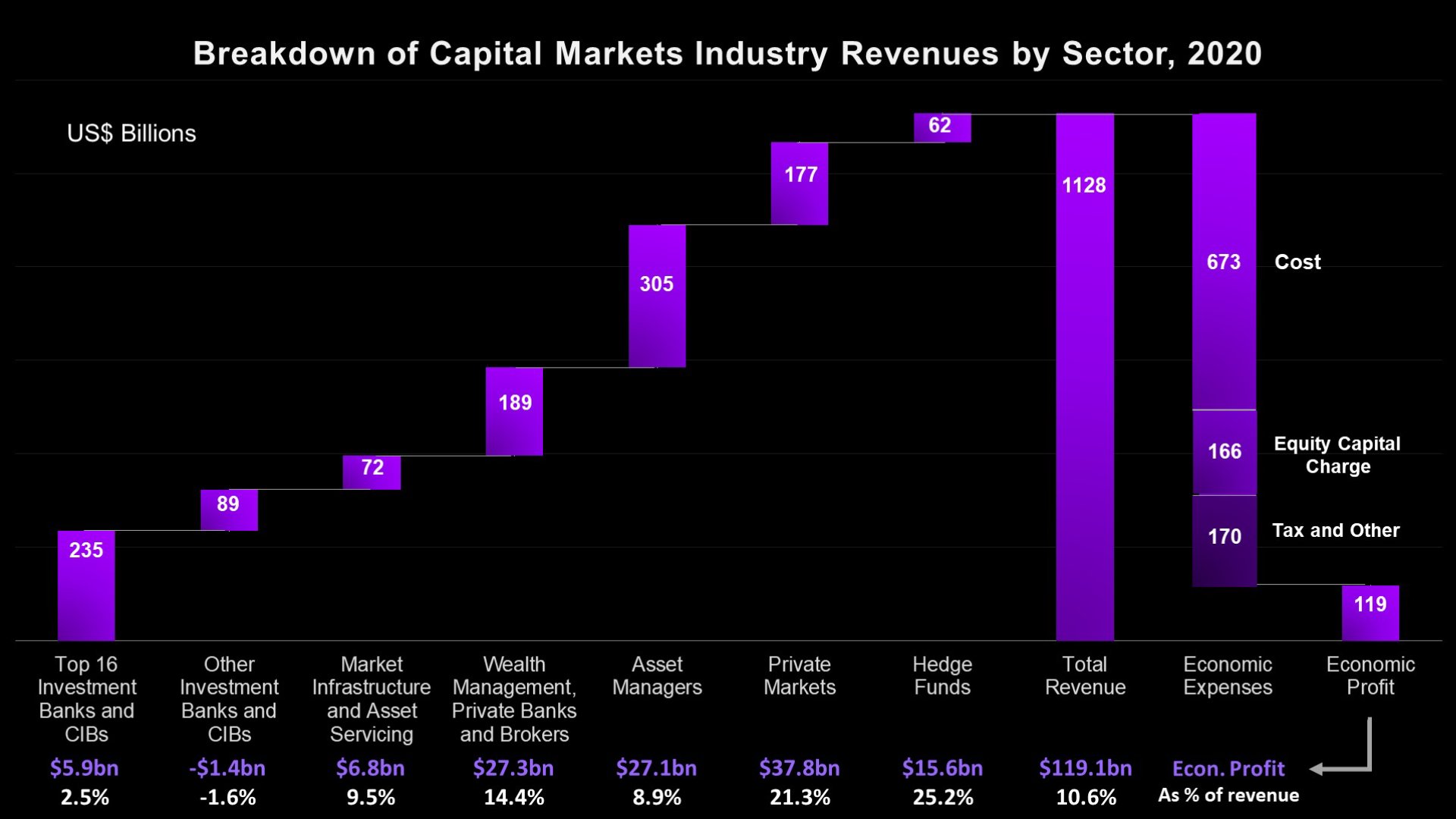

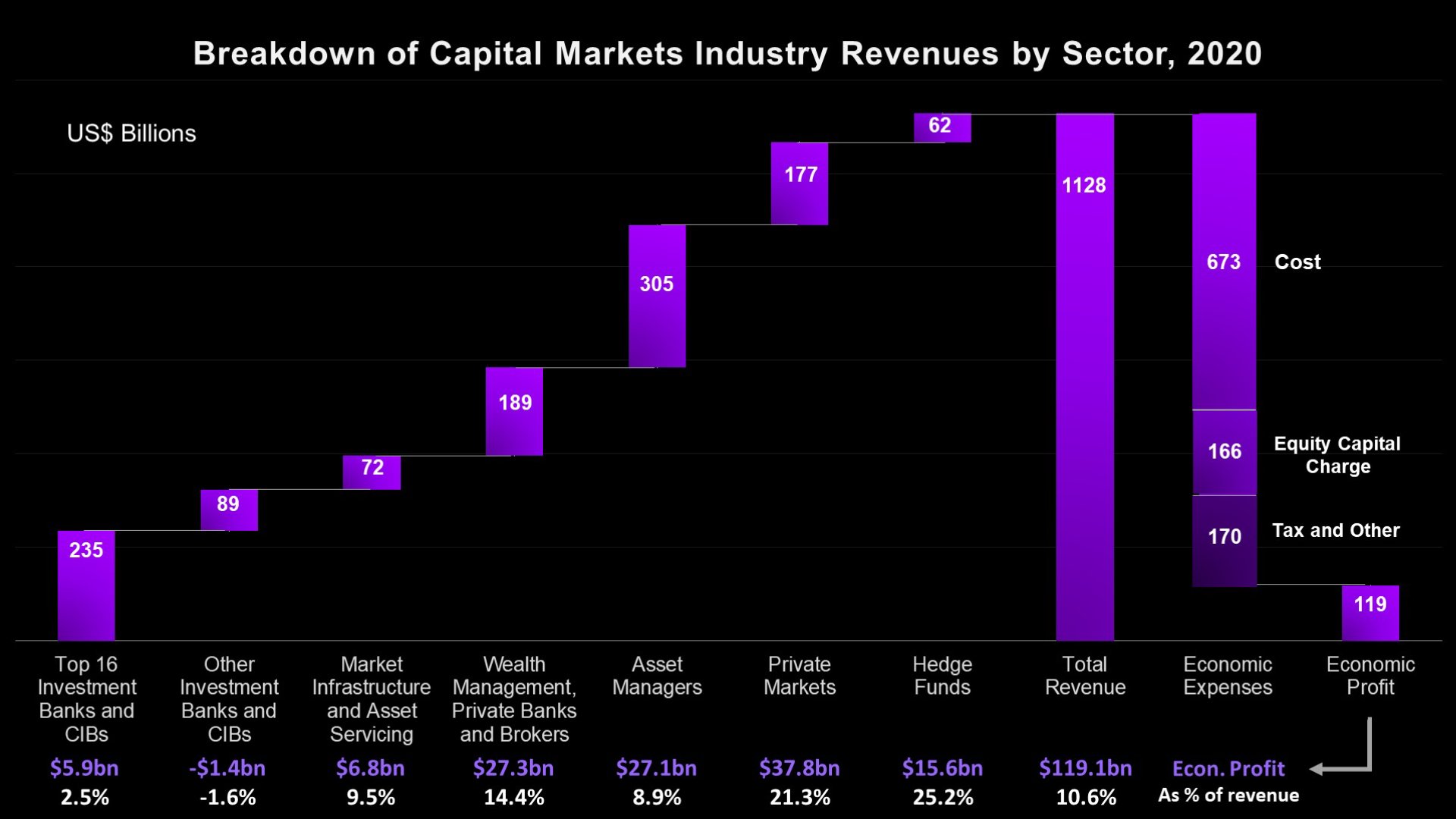

The global capital markets industry saw in 2020 a temporary respite from the largely limited growth the industry had seen in the years leading up to it. Driven by market volatility, industry revenues reached near-record levels on the sell-side and in the exchange sector. The buy-side saw good growth in assets under management and short-term profitability was strong for many firms in the industry in 2020.

Capital markets leaders today have an opportunity to turn a short-term rebound spurred by 2020 events into more sustainable businesses of the future. How? By investing in game-changing technologies, as well as new business and talent strategies.

For several years, technology-led innovation and the creation of new digital value chains remained the key industry disruptors. Now, a global pandemic has increased the scope for change and has also created a greater willingness by capital markets leaders to embrace new ways of doing business.

But one key question remains: What might the capital markets industry look like in 2025? And from that—what should firms prepare for and invest in?

Source: Company Financial Statements, Accenture Research

Investment banking: Investing in humans + technology

In 2025, investment banking leaders will have not only recognized people and technology as key assets to their business, they’ll also have invested toward that end.

The successful, value-creating investment bank of 2025 could be a global scale player or a niche specialist.

Room exists for both types of firms—global scale players and niche specialists—to create value in the marketplace. Regardless of size or target market, we believe all winners will share a combination of greater agility and a clear focus on their chosen strategy. To get there, they’ll need a digitally enabled operating model that keeps costs low while offering enhanced experiences to customers and employees.

By 2025, people and technology capabilities would distinguish true competitors from firms playing catch-up. For the short- and medium-term actions investment banks could take to get there, check out our full Capital Markets Vision 2025.

The successful, value-creating investment bank of 2025 could be a global scale player or a niche specialist.

Firms making digital strides now could take steps that—by 2025—would allow them to be more client-centric than ever before.

Asset management: A new playbook

By 2025, asset managers will have leveraged a new digital playbook that emphasizes artificial intelligence (AI), data and analytics. Stressing capabilities over products, moving beyond cost-cutting to improving client experience and taking a hard look at data strategy are all good moves toward being future-ready.

Wealth management: Client-driven transformation

Being successful in the future may require wealth managers to adopt new business models that are technology-driven and data-enabled, with the client at the center of the value proposition. Wealth management firms would need to find new ways to simultaneously increase profitability and enhance the client and advisor experience, while also digitizing the overall operating model. This means focusing on hyper-personalization, diversified products and services, hybrid advice, revamped distribution and digital end-to-end (E2E) operations.

Private markets: The digitally enabled firm

As more and more private markets firms leverage a platform-based perspective, they would be able to create and deliver a true end-to-end view of the investment lifecycle. To get there, they need a digital operating model—one that gives them command of real-time data, harnesses in-house expertise for continued operational efficiencies and houses a strategy that maximizes investment opportunities.

Exchanges: Fully automated and digital.

The ultimate win would be to achieve full exchange automation with tokenization using blockchain technology, thereby removing the high-cost messaging and reconciliation dynamics of the industry. Several players have announced they are close to go-to-market with digital exchange offerings, and these would have the potential to revolutionize the exchange market as we know it today.

The successful exchanges of 2025 will have adapted their business model to embrace digital transformation to get closer to their clients.

They would have broadened their offerings structure to include data monetization, environmental-benefit linked securities and digital assets. And, like any other successful market infrastructure player, they would maximize the value they get from cloud, AI and advanced analytics allowing them to simultaneously bend the cost curve and create new revenue potential.

Asset servicing: Digital asset custody

Asset servicing firms might move from being heavily focused on post-trade services such as clearing and settlement today to more digital asset custody tomorrow. Safekeeping a digital asset and creating a verifiable authorization framework around it would become more essential as demand for it will rise from investors.

Business and technology strategy are converging. How capital markets firms combine and integrate the two will largely determine their success. Wise moves now could include everything from becoming a “cloud first” business to securing the right people with the right skills. Read our report for more on actions your capital markets firm can take to get there.

We’re here to help your firm become future-ready, now.